QuickBooks Tutorial: How to Create an Accountant’s Copy

January 15, 2013 Leave a comment

Providing your accountant with an accountant’s copy of your QuickBooks file allows her/him to review your QuickBooks file and make changes while you continue to work in your file. Once the accountant has finished making changes, you can upload those changes into your file.

A couple of options exist for creating an accountant’s copy:

- Save the accountant’s copy to a flash drive

- Send the file electronically by uploading to a secure server provided by QuickBooks. This option automatically sends an e-mail notification to your accountant to download the file from the secure server.

Note: Before creating an accountant’s copy, you must be logged in as an Admin user and operating in Single-User mode.

To Save Accountant’s Copy to a Flash Drive:

- From the menu bar, select File, Accountant’s Copy, Save File.

- Select Accountant’s Copy and click Next.

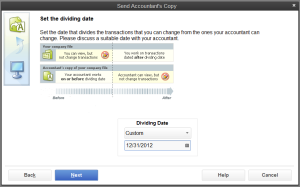

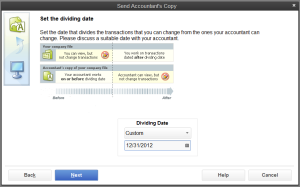

- Set the Dividing Date and click Next. (This is an important date as you will not be able to make changes to your file before the dividing date while the accountant has the accountant’s copy. Likewise, the accountant will be unable to make changes to transactions within the accountant’s copy file after the dividing date).

- Navigate to the location of your flash drive and click Save.

To Send Accountant’s Copy via QuickBooks Secure Server:

- From the menu bar, select File, Accountant’s Copy, Send to Accountant.

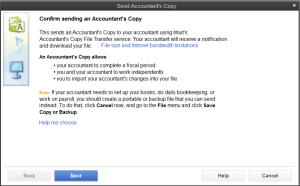

- Click Next to confirm you would like to create an accountant’s copy file.

- Set the Dividing Date and click Next. (This is an important date as you will not be able to make changes to your file before the dividing date while the accountant has the accountant’s copy. Likewise, the accountant will be unable to make changes to transactions within the accountant’s copy file after the dividing date).

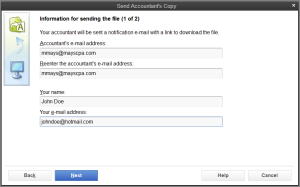

- Enter your accountant’s e-mail address (two times for confirmation), your name, your e-mail address, and click Next.

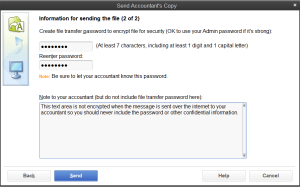

- Enter a password for the upload/download of the file and click Send. (Note: this is not the password the accountant needs to open your company file. Rather this is the password to download the file from the QuickBooks secure server. The password must be a ‘strong’ password, meaning it must contain a minimum of 7 characters, both letters and numbers, and at least one uppercase letter. You may also enter a message for your accountant; however, the message text is not encrypted when sent over the internet so do not include the password or any other confidential information in the message area).

- A message will display to indicate all windows must be closed to create the accountant’s copy. Click OK to continue.

- You will receive a message to indicate the file is being created.

- You will receive a successful upload message when QuickBooks has finished uploading the file.

- Provide the file transfer password to your accountant so she/he may retrieve the file.